fremont ca sales tax rate 2020

Did South Dakota v. The US average is 28555 a year.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

. The California sales tax rate is currently. Please ensure the address information you input is the address you intended. City of Watsonville is 925.

Did South Dakota v. The minimum combined 2021 sales tax rate for fremont california is 1025. The US average is 73.

There is no applicable city tax. Rates Effective 07012020 through 09302020. A similar situation exists in Utah and Virginia.

The december 2020 total local sales tax rate was 9250. These rates are weighted by population to compute an average local tax rate. State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary.

State Revenue Department websites Lower Higher VT NH 622 36 A 625 35 CT 635 33 RI. Average Sales Tax With Local. The Fremont Sales Tax is collected by the merchant on all qualifying sales made within Fremont.

We include these in their state sales tax. The minimum combined 2021 sales tax rate for fremont california is 1025. City of Capitola is 900.

Net Price is the tag price or list price before any sales taxes are applied. The County sales tax rate is. - The Income Tax Rate for Fremont is 93.

There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. You are here. For tax rates in other cities see California sales taxes by city and county.

The US average is 46. Wayfair Inc affect California. Income and Salaries for Fremont - The average income of a Fremont resident is 40815 a year.

31 rows Fremont CA Sales Tax Rate. 5 digit Zip Code is required. This means that depending on your location within California the total tax you pay can be significantly higher than the 6 state sales tax.

Groceries are exempt from the Fremont and Nebraska state sales taxes. The December 2020 total local sales tax rate was 9250. Sales Tax Rates Sales Use Tax Rates Effective 7-1-2020.

California 1 Utah 125 and Virginia 1. Home Departments Tax Collector Sales Tax Rates. The California sales tax rate is currently.

View more property details sales history and Zestimate data on Zillow. Type an address above and click Search to find the sales and use tax rate for that location. Some areas may have more than one district tax in effect.

This is the total of state county and city sales tax rates. Our Premium Calculator Includes. Fontana CA Sales Tax Rate.

Tax Rates for Fremont - The Sales Tax Rate for Fremont is 93. Wayfair Inc affect California. - Tax Rates can have a big impact when Comparing Cost of Living.

Fontana CA Sales Tax Rate. The Unincorporated areas are. You can print a 1025 sales tax table here.

The december 2020 total local sales tax rate was 9250. This is the total of state county and city sales tax rates. The Fremont County Sales Tax is collected by the merchant on all qualifying sales made within Fremont County.

The Fresno sales tax rate is. The minimum combined 2022 sales tax rate for Fresno California is. Those district tax rates range from 010 to 100.

The County sales tax rate is. 31 rows Chula Vista CA Sales Tax Rate. Fremont ca sales tax rate 2020 Wednesday April 27 2022 Edit.

The Fremont Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Fremont local sales taxesThe local sales tax consists of a 150 city sales tax. Some areas may have more than one district tax in effect. The Fremont County Colorado sales tax is 540 consisting of 290 Colorado state sales tax and 250 Fremont County local sales taxesThe local sales tax consists of a 250 county sales tax.

The tax rate in most of those cities is now 1075 percent. B Three states levy mandatory statewide local add-on sales taxes at the state level. 2020 Janelle Cammenga Policy Analyst.

The hike came after voters passed two 05 percent tax hikes in 2020. The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax. The California sales tax rate is currently.

The minimum combined 2022 sales tax rate for Fremont California is. City of Scotts Valley is 975. The Fremont sales tax rate is.

1788 rows California Department of Tax and Fee Administration Cities. The statewide tax rate is 725. Measure C in March and Measure W in November.

City of Santa Cruz is 925. Groceries are exempt from the Fremont County and Colorado state. What is the sales tax rate in Fremont California.

Combined State Average Local Sales Tax Rates January 1 2020 TAX FOUNDATION Sources. Historical Sales Tax Rates for Fremont 2022 2021 2020 2019. Did South Dakota v.

The California sales tax rate is currently. Find out whats. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

New Sales and Use Tax Rates in Fremont East Bay Effective April 1 - Fremont CA - California State Board of Equalization officials say. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. 1092 556 less Federal Income Tax.

You can print a 1025 sales tax table here. The tax rate given here will reflect the current rate of tax for the address that you enter. Describe Californias sales tax as 60 percent.

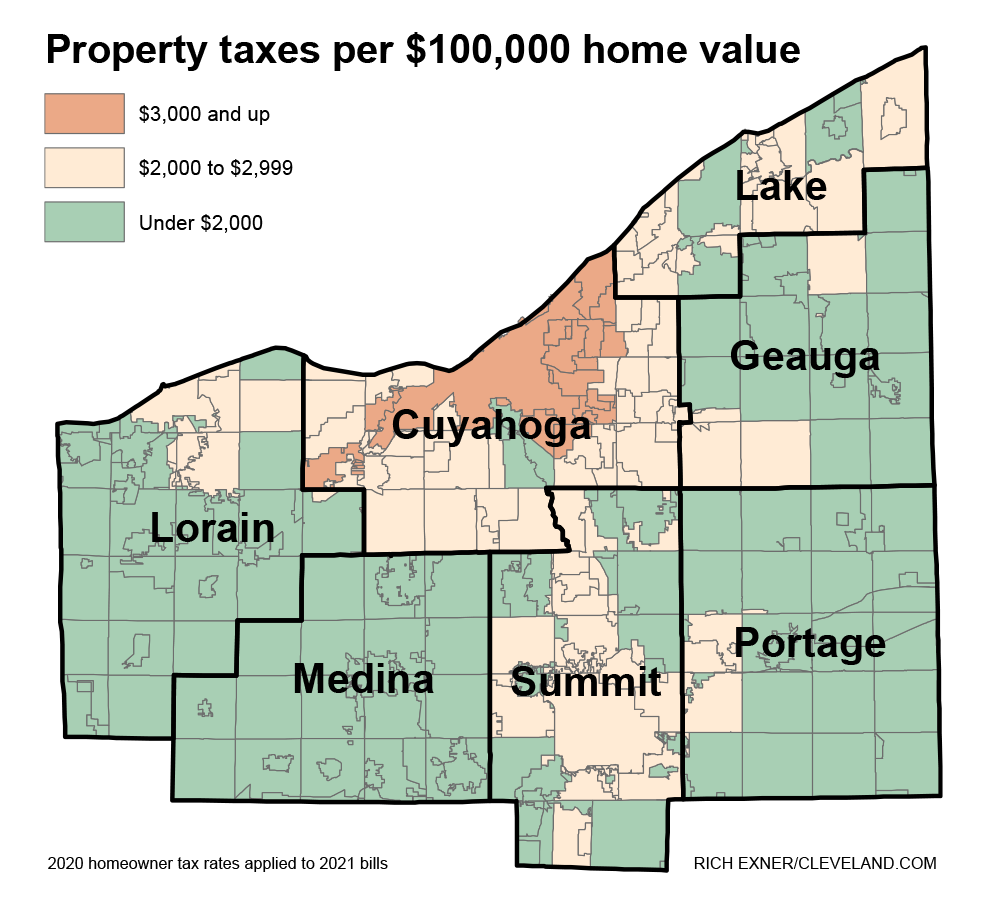

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Food And Sales Tax 2020 In California Heather

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Why Households Need 300 000 To Live A Middle Class Lifestyle

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Food And Sales Tax 2020 In California Heather

Why Households Need 300 000 To Live A Middle Class Lifestyle

California City County Sales Use Tax Rates

How To Calculate Cannabis Taxes At Your Dispensary

Food And Sales Tax 2020 In California Heather

California Sales Tax Guide For Businesses

Missouri Sales Tax Rates By City County 2022

Food And Sales Tax 2020 In California Heather

California Sales Tax Rates By City County 2022

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia